ANGELA RUIZ-CORTINA

Practising and Licensed Lawyer

Member of the Malaga College of Lawyers

NON-RESIDENT TAXES

From the day you purchase Real Estate Property in Spain, you become liable for filing Spanish non-resident tax. The tax/liability is calculated using as a base the annual rates (Valor Catastral). A Tax form is filled and filed via the Tax Office web site, and paid by direct debit set up directly from the tax payer´s Spanish account.

When?

As an example if you purchased a property in 2020, “sale by date” would be the 31st of December of 2021. So the last day of each calendar year is the last day for filing the non-resident taxes due for the previous year. Our office prepares the annual non-resident taxes for a large number of clients around October each year. Please contact us to provide you with an estimate of your costs.

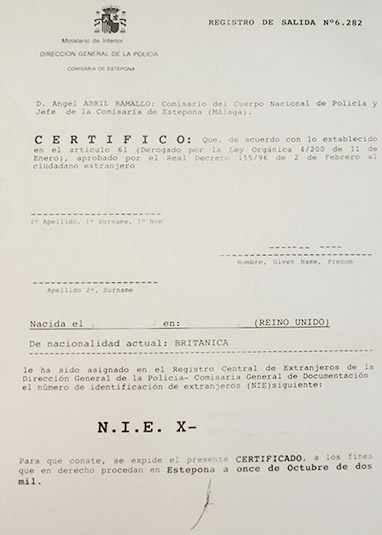

NIE NUMBER

A NIE stands for Fiscal Identification Number. It is required in Spain when purchasing property. Be it by way of inheritance or direct purchase. This can be requested and obtained at the Police Station nearest where the property is located. A form needs to be filled in with the person´s details, a Tax form also needs to be filled in and taken to the bank for its payment prior to presentation at the Police Station for NIE request together with passport copies and original before they will issue the needed number. Our office can help you by providing you with the forms and filling in the correct fields. If you are unable to travel to Spain, our office can request the NIE for you, but you will need to empower us to do so. As an alternative, you can contact your nearest Spanish Consulate to request the NIE.

TIE cards

If you are an EU or a British National with the green Community/EU citizen card issued before the end of 2020, you can apply for a Foreigner Identification Card at your nearest National Police Station. Form ex-23 and tax form 790, a Certificate of Empadronamiento (Council registration) among other documents will be needed prior to making an appointment at the Police Station. Our office can prepare these for you.

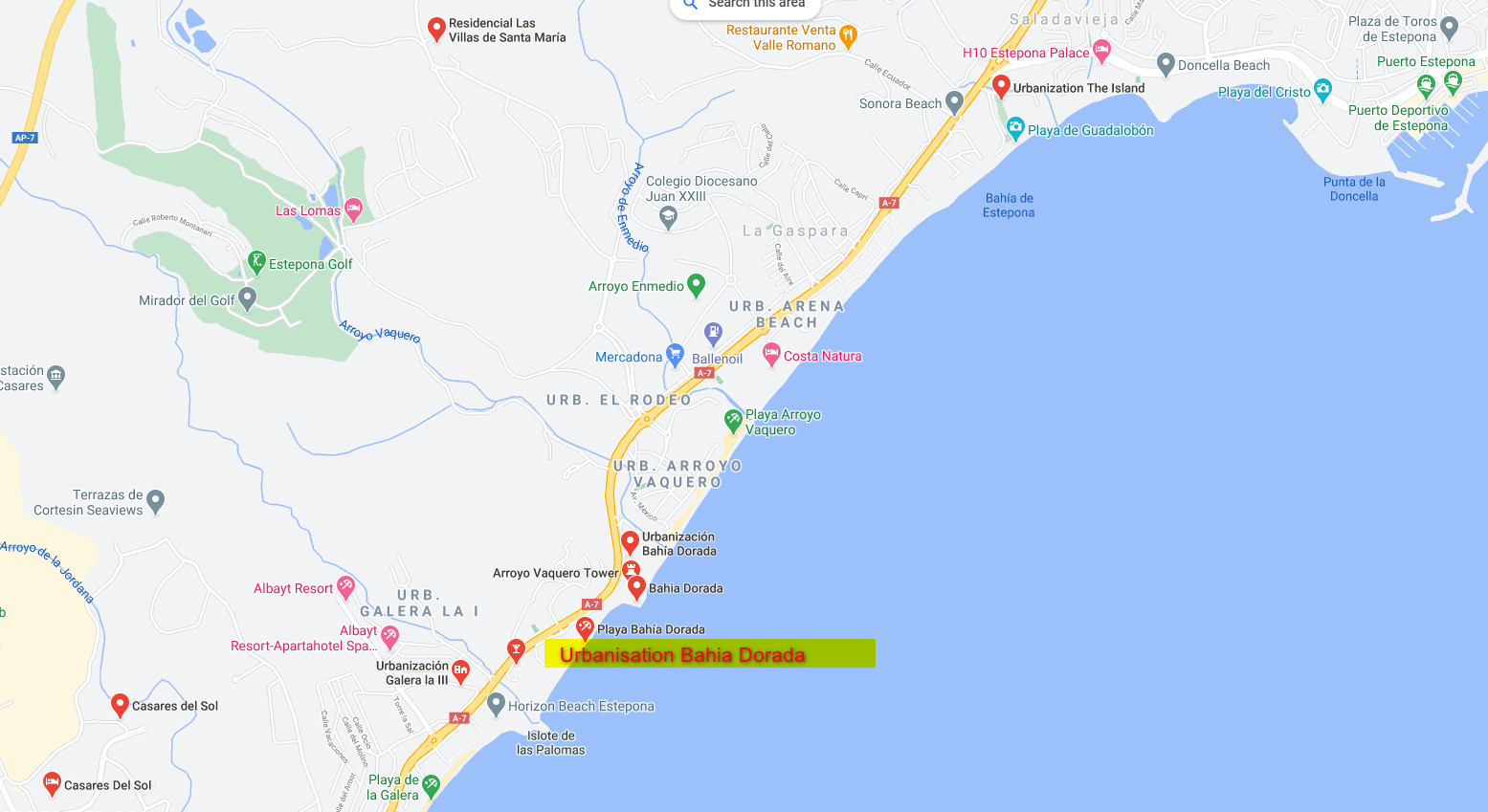

Find Us At

Calle Maestro Serrano 5, Urb. Bahía Dorada 27, Estepona, 29680 (Málaga), Spain

WhatsApp: +34 636 223 197

GPS coordinates: 36º23´41.8”N 5º11´53.8”W

Email: info@spanishlawyer.net

Member of: www.icamalaga.es

Contact Us

How to Find Us